DCHP-2

baby bonus DCHP-2 (March 2016)

n. — informal

a payment to parents or guardians of children, usually paid monthly by the federal government; occasionally as one-time payments (see the 2007 quotation).

Type: 2. Preservation — While precedents existed in 19th-century francophone Canada (see the 1905 quotation), a national plan to support families with children was instituted only at the end of the Second World War as part of a broader reconstruction plan (see also Family Allowance). Family Allowance legislation was officially passed in 1944 (see Canadian Encyclopedia reference). After 1989 the family allowance was paid solely to low income families. In 1992 the Conservative government established the current Child Tax Benefit program (see also Canada Child Tax Benefit and the 1992 quotation) which oversees Family Allowance, Refundable Child Tax Credit and a non-refundable child tax credit. In 2006, the Universal Child Care Benefit of roughly $100 per child per month was initiated, which was increased to $160 in 2015 just before the General Election.

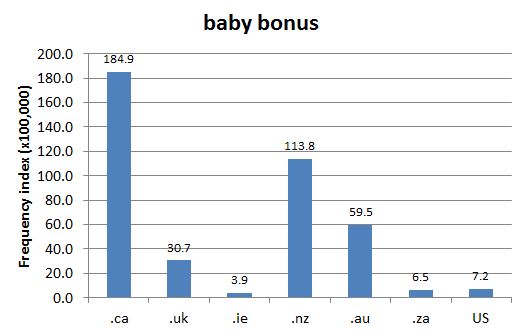

Internet sources show that the term is used most frequently in Canada (see Chart 1), with similar programs in existence in Australia and New Zealand.

See also COD-2, s.v. "baby bonus" which is marked "Cdn. Informal", Gage-1, s.v. "baby bonus" which is marked "Cdn.", ITP Nelson, s.v. "baby bonus" which is marked "Canadian".See also: Family Allowance Canada Child Tax Benefit

- The term baby bonus continues to be used informally in reference to the current Canada Child Tax Benefit and the Universal Child Care Benefit.

References:

- COD-2

- Canadian Encyclopedia s.v. "Family Allowance" Accessed 29 Feb. 2016

- Gage-1

- ITP Nelson

Images:

Chart 1: Internet Domain Search, 4 Feb. 2014