DCHP-2

chartered bank DCHP-2 (July 2016)

Non-Canadianism

n. — Finance, Administration

a banking institution in Canada, chartered by Parliament and functioning under the provisions of the Bank Act.

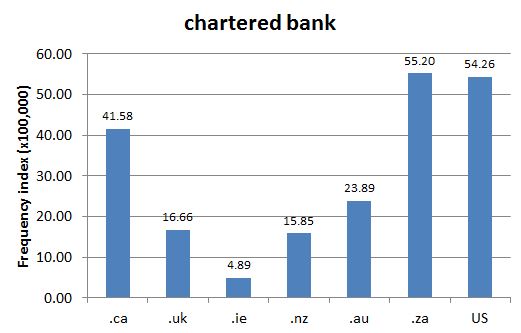

The first chartered bank in Canada, The Bank of Montreal, was established in 1817 and was chartered by the Province of Lower Canada in 1822 (see Canadian Encyclopedia reference, s.v. "Bank Architecture"). Currently, banks are chartered by the Canadian federal government and operate by the regulations of the Bank Act (see Canadian Encyclopedia reference, s.v. "Bank Act"). The Canadian banking system categorizes banks in three categories: Schedule I (domestic banks), Schedule II (foreign bank subsidiaries), and Schedule III (foreign bank branches) (see CBA reference). As Chart 1 shows, the term is used predominantly in the US. All other claims and Canadianism types do not apply as well.

See also Gage-1, s.v. "chartered bank", which is described as "in Canada", COD-2, s.v. "chartered bank", which is marked "in Canada", ITP Nelson, s.v. "chartered bank".References:

- CBA "Banks Operating in Canada" Accessed 6 Feb. 2014

- COD-2

- Canadian Encyclopedia s.v. "Bank Architecture" Accessed 2 Jun. 2016

- Canadian Encyclopedia s.v. "Bank Act" Accessed 2 Jun. 2016

- Gage-1

- ITP Nelson

Images:

Chart 1: Internet Domain Search, 12 Feb. 2014